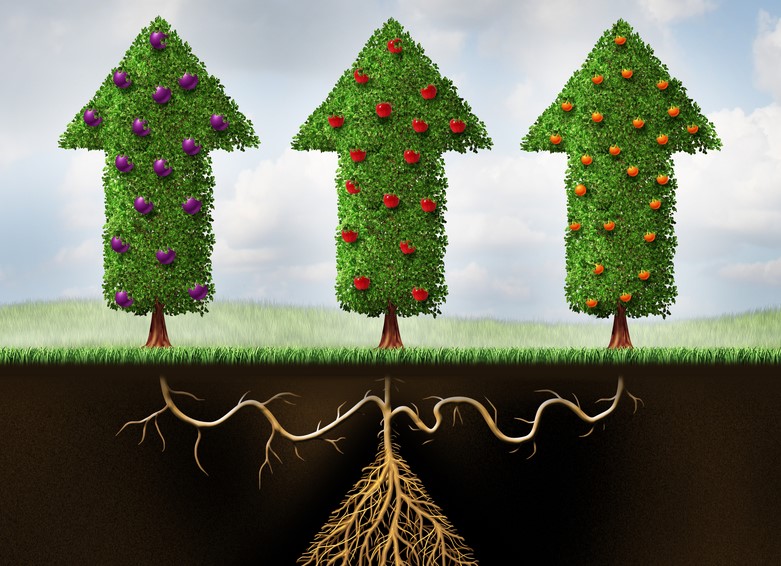

Diversification – why it should be your best friend

Diversification is the act of spreading the money you have to invest across a number of different types of investments. For example, rather than putting all your money into shares in one company, you split it across multiple shares in companies which operate in different industries or different countries. You might also spread to other types of investments like bonds or property.

Why do this? Because different investments behave in different ways. When one peaks, another may plummet, while another stays flat. Some provide investment returns in the form of income (for example, dividends or rent), others through increasing in value. Diversification ensures that an investment portfolio is not at risk of suffering too much if one or more of its parts fall in value.

Diversify, yes – but also think of your objectives

Diversified investment portfolios vary substantially, but can be grouped according to what the owner (the investor) wants from their portfolio and how much risk they are prepared to take on. Broadly speaking, we can bucket portfolios under one of three labels: conservative, balanced and growth.

Conservative portfolio:

This may have the bulk of its money (70% or more) invested in cash and fixed interest (bond) investments, with the rest in growth assets such as shares and property which are, generally speaking, more volatile. This type of portfolio is designed to achieve lower variability in returns, albeit with lower returns than balanced and growth portfolios.

Balanced portfolio:

As the name suggest, more of a balance, with around 30% – 40% invested in cash and fixed interest and the remainder in growth assets, with slightly more varied returns through time.

Growth portfolio:

The alter-ego of the conservative portfolio, this kind of portfolio will typically have at least 70% – 85% in growth-oriented investments, aiming to provide higher returns over the long term, but with a greater likelihood of shorter term volatility. This means in some years you could see losses – even significant losses – but also higher returns in the good years.

The traps of diversification

When you manage an investment portfolio on your own, there are many risks to contend with. First is a basic lack of knowledge. ASIC research shows that 10% of people have at some point invested in something they didn’t understand, and 69% of people either had not heard of or did not understand the concept of risk and return trade-off. Furthermore, some 41% of people view real estate as a low or very low risk type of investment. A lack of knowledge and experience means many investors could be open to:

- Buying into an investment before prices drop significantly, or selling before they increase (known as timing risk)

- Failing to understand which investments are low risk and which are considered high risk

- Investing too much in one investment simply because it has already performed well.

The concept of not putting all your eggs in one basket seems logical, but working out how you do this with your own money and actually doing it – yourself – takes a lot more effort. A financial planner can sit down and help you work out what you want from your money over time and define your financial goals. Furthermore, Australia has a well-developed market for investment products, including managed funds, to provide one-stop diversified investment options for individuals.

About managed funds

Investing in a managed fund allows you to access investment professionals to manage your money. In a managed fund your money is pooled with that of many others. The investment manager controls where this pool of money is invested, using their investment process and experience to the mutual benefit of the investors. The investment manager cannot just invest where they please; each managed fund has its own governance structure, rules to abide by and specific investment objectives – like providing long term growth, or regular income.

There is a wide range of managed funds available including well diversified options such as conservative, balanced and growth funds. You will pay a fee for ongoing management, but beyond the investment manager’s expertise, what you buy is freedom to ‘get on with life’, as managed funds are one of the easiest ways for time-poor or knowledge-poor people to establish and manage a diversified portfolio.

Source: BT